New appointment strengthens operations team at Pulse Finance

For media enquiries please contact hello@pulsefinancelimited.com

New appointment strengthens operations team at Pulse Finance

Flexible finance engineers growth for CSL Engineering in a competitive market

Pulse Finance promotes Parfett to HR Manager

Supporting Sustainable Growth at Empty Plates Catering Services

What Clients really want from their Funder: Beyond the facility

After a challenging 2025 refocus and prepare your business for 2026.

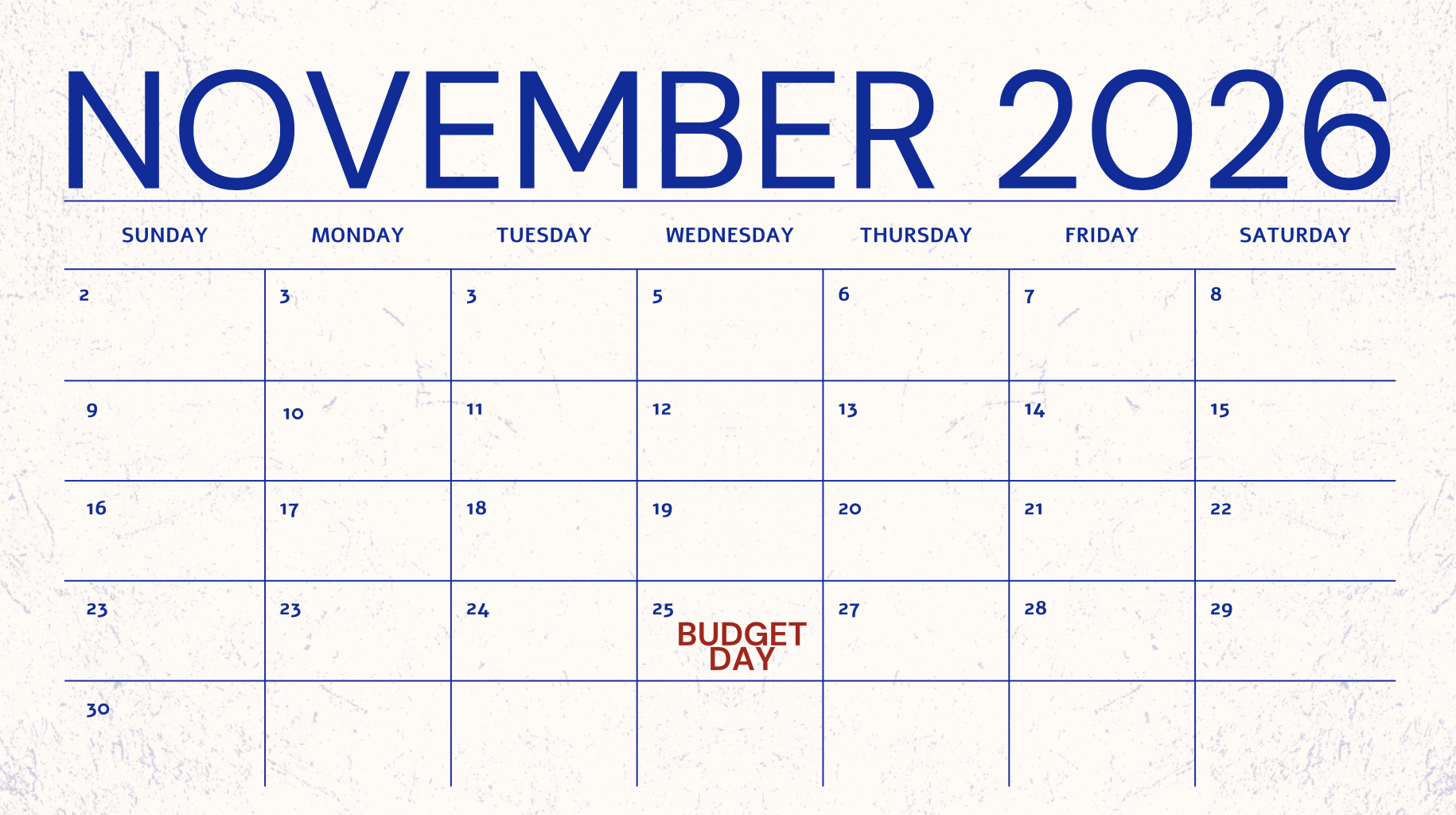

How are you responding to the UK Autumn Budget 2025

Pulse Finance supports event-sector business to strengthen cashflow and scale with confidence

Restore business confidence, unlock investment, and drive UK growth

Driving Fleet efficiency through strategic funding solutions

If you are looking for a funder to deliver scalable finance solutions for your business, get in touch with our team today.